Table of Contents

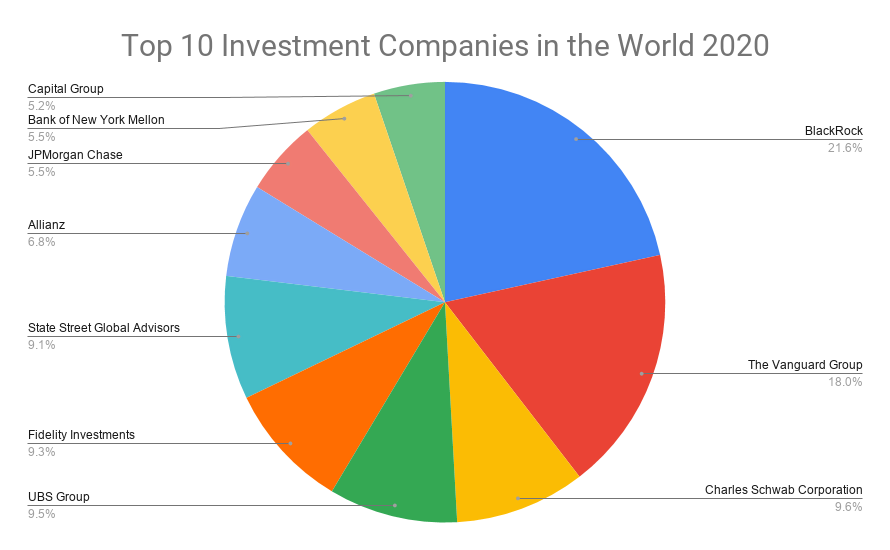

Financial investment companies spend money on behalf of their customers who, in return, share in the revenues and losses.

Investment companies do not consist of brokerage companies, insurance policy business, or financial institutions.

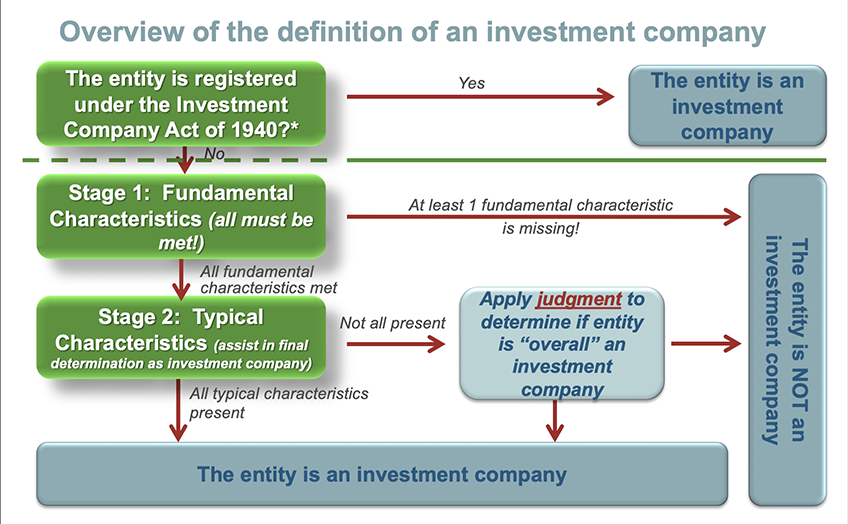

A major type of firm not covered under the Investment Firm Act 1940 is exclusive investment firm, which are simply personal companies that make financial investments in supplies or bonds, however are restricted to under 250 capitalists and are not managed by the SEC. These funds are commonly made up of extremely rich financiers.

This gives particular securities and oversight for investors. Regulated funds usually have constraints on the types and quantities of investments the fund supervisor can make. Commonly, controlled funds might just spend in noted protections and no more than 5% of the fund might be purchased a single protection. The bulk of investment firm are mutual funds, both in regards to variety of funds and possessions under monitoring.

Investment Company around San Angelo

The very first investment company were developed in Europe in the late 1700s by a Dutch trader that wished to enable tiny investors to merge their funds and expand. This is where the concept of investment firm originated, as stated by K. Geert Rouwenhorst. In the 1800s in England, "investment merging" emerged with trusts that resembled modern-day mutual fund in structure.

Brand-new securities regulations in the 1930s like the 1933 Securities Act restored financier self-confidence.

In 1938, it accredited the production of self-regulatory companies like FINRA to oversee broker-dealers. The Stocks Act of 1933 calls for public protections offerings, including of investment firm shares, to be signed up. It also mandates that financiers get a current syllabus defining the fund. "Financial investment Firms". U.S. Stocks and Exchange Payment (SEC).

Investment Management

Lemke, Lins and Smith, Regulation of Financial Investment Companies, 4.01 (Matthew Bender, 2016 ed.). ACM. 2023.

In retail mutual fund, thousands of capitalists might be entailed through middlemans, and they may have little or no control of the fund's activities or understanding concerning the identifications of various other investors. The prospective number of investors in a personal financial investment fund is usually smaller than retail funds. Personal investment funds often tend to target high-net-worth individuals, consisting of politically revealed individuals, and fund supervisors may have a close partnership with their client financiers.

Easy funds have actually been growing in their market share, and in some jurisdictions they hold a significant portion of ownership in openly traded companies. There are various classifications for mutual fund. Some are closed-end, implying they have a fixed number of shares or funding, whilst others are open-end, indicating they can expand into endless shares or resources.

The rates, risk, and terms of derivatives are based upon an underlying possession, and they permit investors to hedge a position, rise leverage, or speculate on an asset's adjustment in worth. A capitalist could own both a stock and a choice on the exact same stock that allows them to market it at a set price; consequently, if the supply's rate drops, the choice still preserves worth, decreasing the financier's losses.

Whilst thought about, provided the emphasis of this briefing on the robot of corporate vehicles, a complete therapy of the advantageous ownership of assets is outside its extent. A financial investment fund works as a conduit to take advantage of several properties being held as investments. Financiers can be individuals, corporate automobiles, or institutions, and there are typically a number of intermediaries between the financier and financial investment fund as well as between the investment fund and the underlying monetary properties, specifically if the fund's units are exchange-traded (Box 1).

Mineral Rights Companies

Depending on its lawful form and framework, the people working out control of a mutual fund itself can differ from the individuals that have and gain from the underlying properties being held by the fund at any offered moment, either directly or indirectly. Both retail and private investment funds commonly have fund supervisors or advisors that make investment decisions for the fund, choosing safeties that straighten with the fund's objectives and run the risk of resistance.

and serve as middlemans in between investors and the fund, assisting in the purchasing and selling of fund shares. They attach financiers with the fund's shares and perform professions on their behalf. manage the enrollment and transfer of fund shares, maintaining a record of investors, refining possession changes, and providing proxy materials for shareholder meetings.

Navigation

Latest Posts

Landscape Design Contractor servicing San Angelo

Investment Management Companies around San Angelo

Investment Management